The United States government does something that no other government in the world does—it publishes over 208 fields of contract data about every single contract transaction worth more than 25,000 US dollars going back over 35 years. This data is available for free online right now, and companies looking to do business with the U.S. DoD can explore this data to help them identify the right buyer for their products and services.

In this webinar, Judy Bradt, CEO of Summit Insight and former Canadian Trade Commissioner at the Embassy in Washington, walks attendees through finding and analyzing this data to find the right U.S. DoD buyer for their products and services.

Start with Who’s my Buyer?

Those who will be successful will start your research into this data looking for the answer to the question, Who’s my buyer? How do they behave? Who do they love? How do they buy it?

Since the U.S. DoD is such a big market, if you can focus your efforts, you’ll decrease your business development costs, improve cash flow, save time, gain a competitive advantage, raise your buyer’s confidence in wanting to talk to you, get more follow-up meetings, increase your win rates, and improve your contract performance.

Source: Summit Insight

The next thing to consider is the type and size of opportunity you want to pursue. You don’t want to be looking for an opportunity that’s ten times the size of your current company because not only will it be difficult for you to deliver, but you’ll also look like a big risk to prospective buyers, which will not get the conversation started.

Your DoD buyers will want to know that you’ve solved their problem for someone who looks just like them. This means you want to give examples of work you’ve done that are of a similar value in size, location, and duration to the problem that your prospective buyer has. This is where competitive analysis gives you the focus to answer that question.

Data to explore

The U.S. federal market intelligence cycle generates a lot of interesting and helpful forecasting and contracting data. Every federal agency, including the ones in the intelligence community, publishes acquisition forecasts, pre-solicitation activities, and formal ways to engage with your buyer before the formal competition even starts. After the solicitation is issued and the contract is awarded, the data about the contracts that have been awarded gives you clues to start building relationships before the cycle starts over again. And that is critical to winning faster and generating more success.

The 208 data fields in U.S. federal contract data tell a story of who buys what you do, where the work will likely be done, when the current contract is complete, and much more. Understanding when a contract expires and starting work six, 12, or 18 months before the next competition lets you know how the requirements are evolving and build relationships with the players at all five layers of the DoD buying cycle.

Source: Summit Insight

What to look for in the data

Data analysis supports business decisions and prevents time and effort waste. It helps you answer questions like which agencies are our best prospects, where they are located, what they are looking for, when we should approach them, how can we make it easy for them to do business with us, how much competition should we expect, who might we need to team with, and who’s involved in choosing suppliers.

Source: Summit Insight

Start by reading and understanding the fields in the data dictionary. You will want to get a sense of which fields provide relevant information to your business. Next, look at the actual contract record. We will start by looking at the FPDS, which allows you to explore and filter contracts using 26 of the 208 contract data fields.

Source: fpds.gov

Watch the recording as Judy reviews the process she uses to analyze the contract data to find the relevant information and people involved. She will walk you through how to filter the contract data by agency, where to get the names and email addresses of contract specialists and other people involved in the contract, the dates of the contract, estimated completion date, contract value, where the work is being done, information about the company that is currently delivering the services including their NAICS codes and much more.

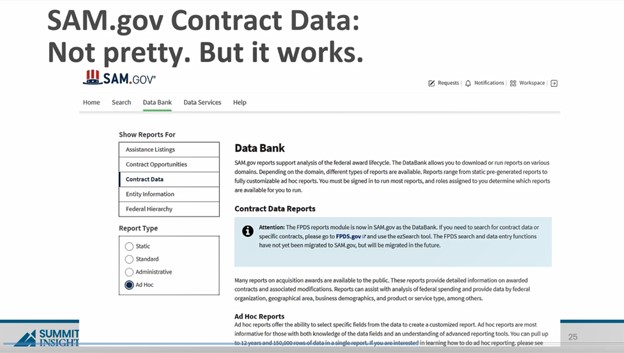

Using SAM.gov to explore contract data

Once you have an account on SAM.gov, go to the Data Bank section on the primary navigation and select ad hoc reports and Award/IDV Information Report (opens in a new window). Six instructional videos that introduce you to ad hoc reports, how to build reports, how to create complex filters, how to filter, drill and sort the data and finally, how to create more advanced ad hoc reports. You will want to export all your reports into Excel.

Source: Summit Insight

Watch the recording as Judy talks through her process for organizing the data to build a story about who the buyer is, where they are, how they are doing the buying, how much they are buying, how much competition there was, who won the contract, what it was worth, when it is over, and how much they could spend.

Source: Summit Insight

Some SAM.gov tips from Judy include

- Capture the last two full fiscal years plus year-to-date

- Experiment for optimal keyword combination

- Cast a wide net, export, then filter in spreadsheet form

Power of the right keywords

The contracting officer decides what NAICS codes and keywords will be used for the transaction or opportunity. If you are trying to win a piece of work and the NAICS code under which the contracting officer published the opportunity isn’t included in your SAM profile, you may not be selected. Look at your competitors’ contracting records to see the NAICS codes they are using, and make sure you’re also adding ones relevant to your company profile.

In terms of keyword development, you want to use different syntax variations. For example, if you do application development, you might also use keywords that include app dev, DevOps, DevSecOps.

Use the root word or prefix rather than the whole word. So, if you do consulting or consultation, use the word consult. Or, if you’re doing construction and engineering, use the word construct. Education-use educ, educating, or education. Purchas, rather than purchase and purchasing. Look up your competitors’ records and see the keywords in their contract award records and contract vehicles. That will tell you much about what your current buyer thinks might be the easiest way to do business.

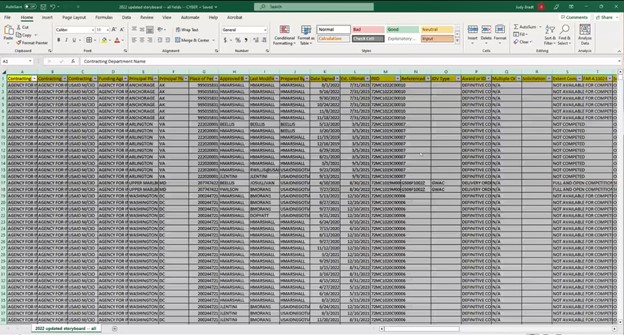

Contract data file export tips

Here are some tips from Judy on how to export the contract data:

- Download the file and store it as a CSV file without headers

- Format and filter the data after you export it.

- Autofit the column width and make all the borders visible to see the full grid

- Put a filter across all the top of the columns.

- Format the first row, so it is yellow so you can see the headers

- Save it as an XLSX file

- Use the filters at the top of each column to filter out contract data

Source: Summit Insight

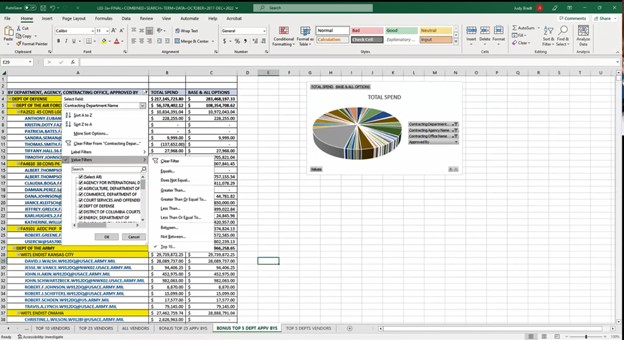

Judy also recommends that you use pivot tables for the questions that you want answered, such as the top department by agency, the top 10 NAICS codes, the top 10 PSCs type of contract vehicle, completed by solicitation procedures, the number of bids that are not filled or open, how much sole sourcing they do, and which contract vehicles are used.

The questions you want to answer are:

- Which agencies/offices are our best prospects?

- Where are they located*?

- What are they looking for?

- When should we approach them?

- How easy can we make it for them to buy?

- How much competition should we expect?

- Who might we need to team with?

- Who is involved in choosing suppliers?

Source: Summit Insight

Worth the investment

While researching past contracts may seem tedious, it is worth spending the time upfront as it will:

- Decrease business development costs

- Save time

- Give you a competitive edge

- Raise buyer confidence

- Get more follow-up meetings

- Increase your win-rate

- Improve contract performance

- Drive more referrals.

Videos that may interest you…

More from Who in the U.S. DoD buys what I do

- Keyword variations to use when searching on SAM.gov

- Finding optimal keywords for your SAM.gov description #usdod #governmentcontracts

- Details in U.S. government contract data so you can find agencies that will buy your products

- What questions to ask from U.S. government contract data – #usdod

- Using past U.S. government contracts to find sales opportunities – #usdod

How CCC helps Canadians do business with U.S. DoD

Alright, let’s go. So classic Washington advice. Does anybody remember what the advice that Mark felt the source originally identified in the Watergate scandal as Deep Throat to Bob Woodward? What advice did Deep Throat give Bob Woodward when investigating the Watergate scandal? If you know the answer, I want you to write in the chat what was the advice I let me know if we get any takers here.

We do. We got a

Couple of folks. And what is the advice?

Follow the money.

You got it? Yes. Excellent. So follow the money is really relevant here when you’re doing business with DOD because public contracting means public information. The government of the United States does something that no other government in the world does. The federal government of the United States publishes over 208 fields of contract data about every single contract transaction that’s related to a contract that’s expected to be worth more than 25,000 US dollars going back over 35 years. And that data is available for free online right now if that does not make your head explode, I don’t know what does. But winners focus on the right question. Not what can I bid, but who is my buyer? In our first session, we talked about the chilling fact that 60% of companies that enter the US federal market to do business exit by year five, but part of it is because the companies that are exiting are asking What can I bid?

Those of you who are going to be successful are going to start your research into this data looking for the answer to the question, who’s my buyer? How do they behave? Who do they love? How do they buy? Because if you don’t get it, you don’t get it. No Benjamins. So why is focus so important as business owners? Tell me how these things benefits appeal to you. If you focus your efforts in the federal market and within DOD, which is a very big place, you’re going to decrease your business development costs, you will improve your cashflow, you’ll save time, you’ll gain competitive advantage, you’ll raise your buyer’s confidence in wanting to talk to you, you’ll get more follow-up meetings, increase your win rates and improve your contract performance. Worth it. I should think so. Now there’s a qualitative and a quantitative approach to focus. If you really don’t want to dig in and do the data, I will tell you that if you just think about what kind of project or contract client is your sweet spot client right now today, they pay you on time, they come back for more, they send their friends, they know when your birthday is, the nature and size and location of those that sweet spot client.

You could do orders or contracts like this all week long with your hands tied behind your back that gives you a model or a template for what are the characteristics of the kind of opportunity or business that I should be looking for that’s most similar in DOD, the military services and the commands. Okay, so define the type of sweet spot opportunity because you want to be doing your best. You don’t want to be looking for an opportunity that’s 10 times the size of your current company because not only will you feel shaky, you’re going to look like a big risk to your prospective buyers and that doesn’t even get the conversation started. So qualitative approach, what’s your most profitable and sweet spot type of opportunity? Your best prospects, your clues to that include your capacity and your track record. Remember we talked about your federal buyers being one of the most risk averse life forms on earth.

They want to know that you’ve solved their problem for someone who looks just like them yesterday afternoon. And so you want to be coming up with examples of work you’ve done that are of a similar value in size to the problem. They have similar locations. The project is of a similar duration, whether that’s weeks or months or years. And the problem that you have solved for someone is very similar to the kind of problem that your prospective DOD buyer has. Great, but which better agencies have that problem at a size and a scale that you can help with and who do we talk to? Competitive analysis gives you the focus to answer that question because if you are a kilometer wide and a centimeter deep, nobody is going to care that you are alive. Focus is your friend and I need to express this positively. If you take the time to learn about your federal buyer, you inspire them to want to take the time to learn about you.

The federal market intelligence cycle is generating a footprint of interesting and helpful data with every step from the forecast. Again, I don’t know who else in the government, in any country publishes a forecast of here’s what we’re planning on thinking about buying. How great is that? Just about every federal agency, including the ones in the intelligence community, publish acquisition forecasts, their pres solicitation activities, formal ways to engage with your buyer before the formal competition even starts. Better yet, after the solicitation is issued and the contract is awarded, the data about the contracts that have been awarded gives you clues to let you start building relationships before the cycle starts all over again. And that is critical to winning faster and generating more success. So in that data cycle, start conversations at the top to go

Ahead. Start by looking back. Federal contract data tells

A story. Those 208 data fields, if you go through them correctly, that’ll tell you who buys what you do. Where will the work likely be done when the current contract is complete? Remembering that it takes lead time to win this work. Getting a sense of when a contract is expiring and then starting work six or 12 or 18 months ahead of the next competition lets you really understand how the requirements are evolving and build the relationships with the players at all five layers. And that’s the next webinar. How do they describe what they’re buying? Who are they buying from now? What was the contract worth? How much did they spend? Who approved the purchase? How many offers they got? How much competition was there? The data shows you all that. How cool is that? It’s detective work. And if you’re thinking, well this is annoying, this is time consuming, you’re going to spend time and you’re going to spend money, all you get to choose is the mix.

And so I will tell you that spending your time doing this research and really focusing and getting to know your best prospects well is a lot less soul sucking than grinding out expensive proposals. Doing what I call writing novels for strangers. That is one of the reasons why people exit the market with empty hands and empty pockets. Data analysis supports business decisions and helps you answer questions like, which agencies are our best prospects? Where are they located? What are they really looking for? When should we approach them? How can we make it easy for them to do business with us? How much competition should we expect? Who might we need to team with? And who’s involved in choosing suppliers? So there are five steps I’m going to share with you to federal competitive intelligence analysis. So here we go. Master the first principles I talked about there being 208 fields of data.

Read the data dictionary, understand what are these fields, what is this information that’s there? So you can figure out what it means when somebody says that they have the I-D-V-P-I-I-D. If you don’t know what that is, then you don’t realize that the indefinite delivery vehicle is not the courier truck that does not find your house. It is the open jaw contract that’s a little bit like master standing offer and there’s a specific unique identifier that tells you what that is. For example, you need to know what you’re looking at. So invest the time, skim down those fields and get a sense of which of those data fields is telling you something that you really need to know. And you can understand the values in each of those fields. If you’re participating in the DOD marketplace, you’re thinking about it. We talked about the importance of having a correctly completed registration for your business entity on sam.gov.

That is free. CCC helps its clients figure out how to do that. And once you have an idea on sam.gov, you’ll have access to this, all this free pass contract award data, as well as current information that is in some cases being fed through other platforms. But only when you have an idea on Sam will you have access to the past contract award data. And so this is the screen and where to get it. Next up, let’s look at a real contract record. Federal procurement data system is where the buyers enter the data. It’s also a place where you can do a limited search and just kind of get a little bit of an idea of what’s happening on contract information. So I’m going to go and I’m going to change my share and I’m going to go over to another screen so that you have the chance to see the contract award data as it’s published at a high level. And you can do this as well. Anu, can you see my screen now?

Yes I can.

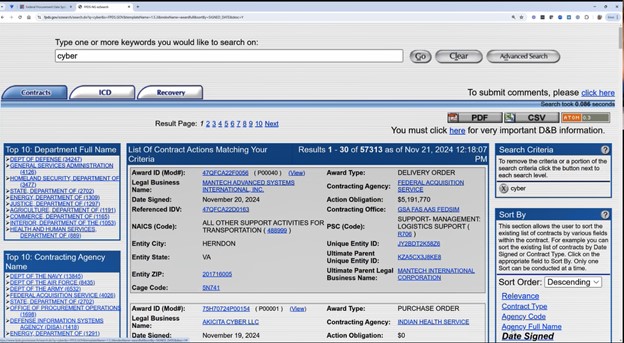

Okay. And if you are really an overachiever, you can open another window in your browser and this is free, you can go to fps.gov. fps.gov. And so this is the system where the buyers enter the data. It isn’t where you can get much of the data back up, but you can get about two dozen of those 208 fields. And I’m going to show you some data records for a second here. Alright, so I’m going to search on the word cyber. Here we go. Now this is not the prettiest database you ever saw and look, the contract at the top of the search, there are, let’s see here, what is it? 57,313 contract data fields and the one that shows up at the top for whatever reason was awarded on June 1st in 2020. Lovely. I’m going to go down to the right hand nav under date signed and I’m going to click on signed.

Now, something was awarded yesterday to a company called ManTech Advanced Data Systems. This was a delivery order for $5 million. It was awarded through the federal acquisition service, specifically the General Services Administration FEDSIM office. And so we can see here, if we scroll down, there’s a purchase order for $0 is here. So that might’ve been the setup or an administrative action just setting up the contract. You’ve got some negative numbers here. Sometimes that might’ve been a budget adjustment or moving budgets around. These are all very normal. Again, zero a definitive contract is just setting up, setting something up, delivery order. Look at some of these. I’m going to try to find one that’s a little bit interesting. Alright, and here we go. Delivery order $0 definitive contract for ultraviolet cyber Fascinating. Zero zero $2 million. This looks kind of juicy. Cyber data technologies for health and human service.

I’m going to find the ones that are in DOD, right? So let’s go into, just look at the DOD cyber ones. Now that’s only 34,247 of those guys. Alright? And so the last award that’s sitting here is August. That’s not a surprise. Department of Defense is allowed to lag the publication of their contract award data by 90 days to protect operations. Tempo intelligence. You don’t want your adversaries looking at your purchasing going, ah, they’re staffing up and sending stuff over there. They’re coming for us. No. So the January 1st is when you’re likely to see the full set of publishable DOD contract transactions. Be aware of that. So as we go, looking here, again, that’s a setup, purchase order budget adjustment, definitive contract delivery order, purchase order. Alright, so let’s take a look at one of these guys. Alright, definitive contract. I’m going to look, there’s one other thing I want to look for here for you.

I threat detection. Yeah. Alright, this is a Navy one, A delivery order. Alright for Ty to Athena. So I’m going to take a look at this contract record in full. I’m going to hit view. Here we go. So right up at the top, okay, it’s a delivery or task order. It’s a final one. And look at these three fields. Prepared user last, modified user approved by these are first name, middle, initial, last name, and you don’t have a full working email address. But if you took all the characters after SIV and removed the N 0 0 1 8 9, you would have a working email address for William P. Spencer. Ethan T SSON is going to be somebody that would be a contract specialist working in the office next to William who has signing authority for that contract transaction. Real humans. And we’re going to go back to keep that in mind when you see our next webinar and players at all the layers, these are people in the contracting shop.

We have an award idea, an award identifier, that’s the unique procurement identifier for this transaction. The date on which it was signed on August 22nd. Now this particular opportunity, this particular contract award was signed about just a little over a month before fiscal year end. But the contract is open, the contract is open, estimated completion date is the end of September of 2025. So this solicitation hit the street the beginning of August. They awarded it in three weeks later, not a lot of time. And here they’ve got a year to do the work, whatever that work was for $251,141 and 67 cents. Now that’s an interesting number because that’s just a tad more than the simplified acquisition threshold and I’m curious about why that would be. But action obligation is what this particular contract transaction is worth based on exercise options value. If this were for a bigger contract, then this would be the amount of money they spent on this contract and disperse so far and base on all options value total contract would be the total amount of money that our good buddies William and Ethan have to spend through this contract that they’re authorized.

So this one right now is just authorized as a one-time purchase for $251,000 and the work is going to be completed sometime between now and the end of next September. The contracting office that awarded it within the Navy is Navsup Naval Supply Command, fleet Logistics Center in Norfolk. They’re part of the commander of Fleet Cyber. The fleet cyber command. Now where the work is going to be done is interesting. This is probably, this is information about the vendors where the vendor is located. T Athena LLC is in Herndon, Virginia. There’s a little bit of information about the company where they’re incorporated. This was a firm fixed price contract and you can see some other information. Number of actions. One is a one and done. The work is going to be done. And this is valuable because sometimes the contracting officer, especially in the cyber contract, is going to put the place of performance as the company headquarters here.

They’ve said this is going to be done in actually a few miles from where I’m sitting here and Arundel in Fort Mead, Fort George Mead in Maryland. So this is being done at Fort Mead in suburban Maryland. So the product service code that it was assigned is product service codes are a unique taxonomy that only the US federal government uses to code the type of product or service that is being purchased. And so this one, our 4 2 5 is a research and development category and support is professional engineering technical, the North American Industrial Classification system code. And that is used in Canada, the United States and Mexico. That code is also assigned to this contract. The contracting officer decides how they’re going to categorize what they’re buying. And so the code they used was 5, 4, 1, 3, 3 oh engineering services. The contracting officer gets to decide how they’re going to categorize what they’re buying when contract notices are published on a public award system, including the ones you can access from Canada or if you’re going directly into C, c, C.

Bear in mind that if you search on NS code, if the NS code you pick isn’t the one that the contracting officer decided to assign to this particular purchase, you’re going to miss opportunities that you want to win. So kind of be with that for a minute because that comes down to one of the other fields here. Description of requirements. The contracting team has 250 characters now that they can use to write anything they like about what it is they’re buying. So here while I searched on the word cyber, sure equipment support service is what they said they were actually buying. So why it is that the word cyber even showed up and why this contract got captured is because the word cyber was somewhere in the contract record exactly where not sure IDV number of offers. So here there’s an indefinite delivery contract that was used but no satisfied. They got four offers. Not very many. Not very many. This is a relationship sale. Okay, now I’m going to pause and say this is just a high level, these are not all the data fields that are available, but do you get the kind of information that’s available Annu, I’m going to pause here. Are there questions you’ve got about just looking at this one contract transaction?

Yeah, there are a few questions. Alright, so one of the questions and if you want us to stop sharing your screen, that would be

Easy. Okay?

One of the questions was what’s the approach if the government has not bought your product yet?

Okay, wonderful. If you have never done business with any part of the US federal government before, I want to encourage you, and this is the webinar we’re going to be giving in January to consider what problem you can solve for a DOD buyer. That is, if somebody only has less than $10,000 US in their budget right now, but if you could solve a problem, they’d be willing to work with you for less than $10,000. I want you to think about what problem you could solve for somebody who has just a little less than $250,000 us, because those opportunities are not always published on the bid systems. But if you identify the people who need what you do and can start to get to know them, talk to them about their problems, show them a case study, a white paper link to some articles that really establish your credibility. Come in, meet with them, all the kinds of steps that are involved in building relationships, and we’re going to talk about that in our Players and layers session a little bit Next time you’ll going to build relationships with them and think about what little problems you could solve for them before you think about competing for these big multimillion dollar things I knew. What other questions do we have popping up right now with relate to data?

Here it is. So we’ve worked in the past with GSA approved resellers and provided communication equipment to US military. So they don’t do the actual installations. What this person wants to know is they need to find the names of the resellers and or prime contractors who serve the DOD. Can they access a list within their sector of interest or do they need to start from scratch?

You can access that data right from fpds.gov or another utility that I’m going to tell you about in a moment where you can get even more data. And so if for example, I’m going to back out of this, I’m going to share my screen again, may I do that please? Okay, here we go. I’m going to go back to share screen window and there we go. And so am I back?

You are.

Alright. And so let’s say I go back to my search and let’s say if the person who asked that question would put the buying command or something like that is not Army, but it’s Aberdeen I proving brand or it’s communication electronics command. Give me a specific military installation or a program or a part of a DOD or a military service. Okay? Drop that in

And I’ll show you how it works a little bit. You got anything? I’m waiting to see if anybody responds, but okay, I’m going to presume that for example,

It was communications and electronics command for example. So let’s say it’s within the army. And so let’s say that you’ve identified, you have the code to identify the contracting office. Alright? So this is another piece of data you can search on. So this here is Army contract and command at Aberdeen Proving Ground. That’s communications and electronics command. Alright, let’s say you wanted to find all of the contracts that are there that might be related. Okay, I’m going to take C om out and I’m just going to go search on this term. Okay, hang on a second, I’m going to clear this.

There we go. Alright, so here we have 553,407 contracts. Great. And so within that, let’s say you are looking for stuff that was run through A GSA schedule for example. And so you could go and find just the things that started with the referenced indefinite delivery vehicle. So you’d be looking for a field that started with four seven Q or Gs. Okay? So I’m way in the weeds there. But when you start to understand the data dictionary at that level, you can figure out which of these fields to search on to isolate your data. You can’t see all of it through here. You can, if you go over to CSV and you can export this stuff, you could then get all 553,000 transactions and sort them out there. So some Excel skills are tremendously helpful here. So you can isolate that information. But if you want to see all of the data fields, then you want to go to the part of sam.gov, not for opportunities, but sam.gov contract data and that’s what I’d love to go and share next. Alright,

So before you do that, another gentleman was asking, are you able to see who, which companies bid on an opportunity?

You cannot see who all the people who bid you will be able to see who won. Great question. I love that question. Okay, so on I back up looking at contract records, 208 data fields. When you do an export to CSV, you’re only going to get about 26 data fields. So you’re only really getting literally the tip of the iceberg here. If you want to see all of them, remember you’re going to spend time and you’re going to spend money, all you get to choose is the mix. So take a look at what resources you have. There are data platforms that for empty thousand dollars can make some of this searching faster, but you’re going to pay for it. So detailed, free and cheap. Pick any two, there we go. Cost time, death. You can get it fast and cheap but not deep. You can get fast data and that looks deep, but it’s going to cost you money.

You can get something that’s cheap and deep, which is what we’re about to do now, but it will take you some time. Fast, cheap and deep is fiction. Alright? So bear in mind, but you do need to get this work done because when you do do the search and create focus, you can move forward and spend your time and your money and there’s a considerable amount of time and money spent on business development upfront with confidence rather than waking up every morning going, are we going to win? Yet you need to be able to move forward with confidence. So define your questions, decide what do I need to know? And that avoids what I call feature paralysis because you can look at some of these very large expensive data services and just go down without a trace and get lost and wondering, well what are all these opportunities?

What am I looking at? So sam.gov contract data is not pretty, but it works and you can only access this part of sam.gov if you have an ID on sam.gov itself. When you do go over to the data bank section, you’re going to scroll down and you’re going to select ad hoc, ad hoc reports. Don’t get the standard reports, they’re not going to tell you things that are really useful. You want to find out what’s happening in your part of the federal market and take, dedicate a half a day of your time, split it into a couple of hours. If you’ve only got 60 or 90 minutes of attention, time to dig into data, bring a buddy. It’s more fun to do if you’ve got a friend and somebody who can sympathize with you. But do it together. And on that screen as well, there are total of six instructional little bites of lesson data and it’ll show you how to enter the ad hoc section of sam.gov, how to create a reporting template or query template, how to use it and how to export data into Excel, which is where I recommend that you use it rather than try to manipulate data in their system.

I encourage you to log in, go to ad hoc award, IDV data, watch the training videos, build your query and get in there and play. The good news is it not only doesn’t cost you anything but your time, but you can’t break it. Now bear in mind, sometimes it breaks itself, which is to say, I had one of these really frustrating experiences where I had a big project and I thought it’s a 4th of July weekend, I’m going to go in and do all my data diving on the 4th of July. And it crashed and it crashed and it crashed. And I had some very, not very pretty, very loud words to say as I was sitting out on the patio and my husband said, sweetie, what’s wrong? Second, I said, hun, it’s the 4th of July, they’re all off having burgers. You should go have a burger, just give it a rest.

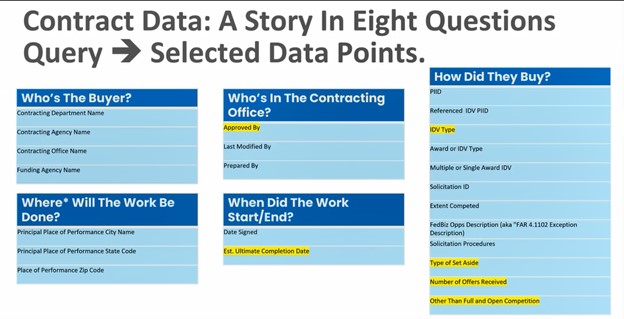

So sometimes the system goes down for maintenance, sometimes you’ve got to go in and out and try a couple of times. That’s normal normally it’s also a pretty reliable place to get the access. But don’t be frustrated if it kicks you out a couple of times. You got to come back at it. All right, so there is something called a storyboard way to organize the data, and I’m going to show you what that is because I use about 65 of the 208 data fields. I don’t use all of them and I assemble them in an order that helps me unpack the story. Who’s the buyer? Where are they? How are they doing the buying, how much are they buying? How much competition was there? Who won the contract? What was it worth? When is it over? How much could they spend? And so I’m going to show you how to organize your data.

Contract data is really a story in eight questions. So you want to set up the structure of your data fields in ad hoc so that each of the questions you have, you’re grouping together the data fields that answer those questions, answering who’s the buyer? The data fields you’ll choose our contracting department name, contracting, agency name, contracting, office name, funding, agency name. Those are the first four fields in my report. Next, where will the work be done? And remember that the principal place of performance name, state and zip code. Sometimes the contracting officer chooses that data, enters the data where the company is headquartered, not where the work is actually being done. So doubled crosscheck that if it’s entered completely, then where the work is done. This place of performance will be different from where the company is domiciled, who’s in the contracting office, approved by modified by prepared by. Sometimes you’ll get full first and last names and a working email address. Almost other times they’ll get HHSP Smith.

But that agency might have another database, an employee directory. You could use LinkedIn and other things to find that person within that buying agency. But that gives you a clue. This is detective work. When did the work start and when did it end date signed estimated ultimate completion date? Then how did they buy the PIID is the procurement identifier, reverenced id bs If they have something like the equivalent of a master standing offer or a multiple transaction contract vehicle, what is that unique identifier? Is there a type of multiple award contract? Was it a multiple award or a single award? IDV, which is to say, is there a small pool of five or six or 25 companies that are eligible for this particular kind of work with this buyer? Or did one company get a contract that can be used over and over again until the money runs out? That’s what that is. Sometimes they’ll give you a solicitation identifier. How did they compete it? Did they use a GSA schedule? Did they do a simplified acquisition? Did they do something else? Did they publish it in sam.gov? How did they solicit? Was the work set aside number of offers received? Did they sole source it? Which is what other than full and open competition means? And what criteria did they use to justify it?

Once again, what did they buy? Remember he said NS code, NS description. We looked at those fields of the record product service code, product service description, then that juicy 250 character description of requirements and did they use purchase card? Then how much did they spend? Action obligation, how much was this transaction based and exercise options? How much have they spent so far on that contract? And based in all options, how much are they authorized to spend total? Then who is the competitor? Where are they? What was their name? What is their unique entity identifier? What kinds of set asides are they eligible for? So all of the information about your competitors, here’s why keywords are critical. I want to go back over this and make sure that when you’re setting up your query, you’re not just searching on product service codes and makes codes.

And so the tips that I want to give you, I want you, when you do your report, you’re going to specify a period for which you’re getting the data. I will tell you, you do not want the last 35 years worth of data. You do want to get the last two full federal year’s worth of data plus year to date. So if I were running report today, for example, the federal fiscal year, federal fiscal 2025 started this past October 1st about six weeks ago. And so I would want my report to go from October 1st, 2022, which is going to give me all of fiscal 2023, all of fiscal 2024, and then year to date, today day experiment for optimal keywords. Because the keywords that get entered in the description of requirements field, it’s like casting a big net when you’re fishing, you’re bringing in all kinds of things, but you’re going to detangle the turtles and release the dolphins, get rid of the data that really isn’t really about you.

And then what’s left? That’s going to tell you what’s in your niche in the federal market and across every single defense and civilian agency, you can filter out and say, just tell me what’s happening in DOD and you’ll have all those transactions and be able to filter them once you get the file into Excel. The power of keywords is this. The contracting officer has the complete power to set what the transaction or the opportunity is going to be. You can pick whatever makes codes and product service codes that you think are legitimately applied to your company. You get to pick those. But the contracting officer gets to decide what the opportunity is going to get coded as. And it’s a minor thing, but if you are trying to win a piece of work and the next code that the contracting officer published the opportunity under isn’t included in your SAM profile.

Somebody could protest if they wanted to and just slow things down to say, Hey, this company, that’s not one of their NS codes. It’s a minor way to slow things down. But most importantly, the description of requirements, if you search on description of requirements, then when you go through the data, you’ll see all the NS codes and product service codes the contracting officer is using when they’re buying something like what you do. That’s intelligence is really helpful. When you take a look at the contracting records of your competitors, you can see all the NAS codes that they have in their company profile and you can make sure that you’re adding ones that are relevant to your company as well. Think of those as like fishing lines in the water.

So keyword development, you want to use different variations of syntax. For example, if you do application development, you might also use keywords that include app dev, DevOps, DevSecOps, use the root word or prefix rather than the whole word. So if you do consulting or consultation, just use the word consult. Or if you’re doing construction and engineering, just use the word construct education. Just eed UK instead of educ educating education purchase rather than purchase and purchasing. And look up your competitors’ records, look at the work that they’re winning, the keywords that are in their contract award records, their contract vehicles. That’s going to tell you a lot about what your current buyer thinks might be the easiest ways to do business.

Get in there and play. You can’t break it, it’s free. And so go to contract award data, ad hoc award, IDV reports take advantage of the instructional videos and they get in there and play. And I’m going to give you a couple of resources to make that a little easier. And so export tips include the search terms in your file name when you download the file and store it. Export is a CSV file without headers and then format and filter the data after you export it. Okay? So this is a bit of a screenshot about what it looks like. So some tips with formatting, and this is what it’s going to look like when you just pull the CSV file. Okay? And so autofit the column width, make all the borders visible so you can see the full grid. Put a filter across all the top of the columns. I turn my first row yellow so I can really see my headers and then I save it as an XLSX file. So that’s what it looks like after I’ve done those things.

Then I can use the little filters at the top of each column and start to sort out, well, gee, I only want the things that have completion dates that are in 2025, for example. And I only want the things that are not in the agency for international development, but just in DOD and just in the Navy and just in Norfolk. So you can really narrow down what’s happening. You can also use pivot tables. So data flyover, you can go across the top and see how it looks when your data has all of the data fields that we talked about. If we’ve got a little time at the end, I may be able to circle back and show you a full flyover. Okay?

So the next step is to create pivot tables based on the questions you want answered. I recommend, and you can screenshot this if you would like. I recommend that you do by department by agency top 10 NS codes, top 10 PSCs type of contract vehicle, whether it’s in sam, pivot by extent, completed by solicitation procedures, by set aside, by number of bids other than full and open, which tells you how much sole sourcing they do. And by contract vehicle. Those are my recommendations for useful pivot tables to do in this analysis. So we got data, how can we use that to answer which agencies are our best prospects? Where are they located, what they’re looking for? How should we approach them? How can we make it easy for them to do business with us? How much competition should we expect? Who might we need to team with? Who’s involved in choosing suppliers? So this is an example of what a pivot table looks like when you’ve gone and separated out by department, by agency, by contracting office. And then we want to know who the top people are that are approving contracts in that command. Now those are real names of real humans. The department of the Army, the engineering district of Kansas City, David J. Walsh, Jesse W. Vance, John Kay Aiken. And you can tell how much the total amount of spending each of them did. So you can really tell literally who the big spenders are

And where they are. How cool is that? So

This is an example of top five departments showing the approved buys helps you go where the money is, follow the money. Another one, you can get insights into teaming approaches or mates by filtering out within the top places where you’re going to focus, who are the vendors that they’re awarding most of the work to and how much of the share of the pie each of them getting. That’s what pivot tables can start to show you. So when you have your data, you can focus with confidence and answer the question, where are our best prospects? Because you’re going to be building relationships with players. That four are the five layers that I’m going to talk about in our next session. Contract data generates contact data. So we covered a lot how to define your research goals. Which data fields are the most valuable for opportunity identification?

How to create the recommended storyboard file structure for a complete ad hoc report. The steps to export your data to Excel, how to create pivot tables of your data and how to use your data to determine where to focus in. We have some time to answer your questions and possibly to go through a real data file. But real quick, I want to ask, do your closing self-assessment on a scale of one to seven. I know why federal competitive intelligence is essential to success. One, strongly disagree to seven, strongly agree, one to seven, I know the questions. I need my analysis to answer one to seven. I know the value of past contract award data and where to find it. And number four, I know how to organize my data to answer these questions. So real quick, write down your closing score. But what I’d love you to drop in the chat is what’s your delta? How much did your numbers change over the last hour? Please drop it in the chat and let me know what kind of numbers we’re getting because that tells us how helpful we’ve been in just what we’ve covered today. And I’ve got some resources. So let me know in the meantime, what’s your aha or takeaway? What was valuable for you or what action are you going to take as a result of what we covered? I’d love to know what’s resonating for you. So drop it in the chat. Let’s see

What’s coming up for you.

So in the meanwhile, I think you have a few more slides to share, right? Or resources.

Real quick resources. I’ve done a really high level flyover of federal competitive data research. If you’re really happy, read the manual, do it yourself or have a great time. Send cards and letters. If you are interested in an experience where someone can be hands-on, do it with you, let me know. I can provide you with an introduction to one of my training partners and you can do get this done with an expert. So you get the combination of training, but you get your report all completed instead of trying to struggle. If you’re not a happy read the manual thing. I am a very big fan of personal instruction. I like a lot of personal attention when I’m not doing government contracting. I am an instrument rated private pilot. I am a professional indoor rock climbing instructor. I’m a certified scuba diver. I’m not an adrenaline junkie.

What these three things have in common is that you learn how to do them with finding the best instructor money can buy who stays by your elbow, keeping your tookus alive. This is how I’d like to live. And if that’s the experience that you want, you’re in the right place. There’s lots of do it yourself resources out there. Finally done for you is also an option You can ask, get in touch with me if you’re interested in knowing what a half day private fullblown analysis will do for you. But there’s lots of good, do-it-yourself resources. And I’m going to give you another one in government contracts made easier. The workbook, which is available on Amazon. We’ve got six different hands-on step-by-step exercises that take you through how to do some of these things. Alright, so by all means, take a stop there, see how that works as a do it yourself resource for you.

Next, an attendee bonus, you can shoot this QR code. Three easy lessons in free federal market research USA spending.gov is a different tool. It’s not going to give you created by approved by, modified by, but it has a friendlier front end and it’s another way to just get your feet wet, get comfortable with federal data, see what there is to see, and you can export and GSA schedules, e-library and acquisition forecast, they’re all in there as well. A little bit of understanding how to use them and how they work. So that’s another bonus for you. So next steps, I’d love to hear what yours are going to be. I encourage you to draft your keyword set. If you haven’t already built a relationship with your CCC advisor, by all means, it may be time to do that. Watch the sam.gov ad hoc training videos, build your query test and play download. Do Excel, create pivot tables for your analysis. I want to encourage you to choose your top three agencies or offices for your business focus. Anu, I’m yours.

Excellent. So if you want to stop sharing your screen, I’ll review some of the questions that have popped in.

Yeah,

Perfect. So you mentioned some free resources. Someone was asking, do you have recommendation on third party tools services that automate and use AI to filter through these systems to find deals and opportunities?

There are some, there’s no specific one that I recommend. If you do a Google search on artificial intelligence and US federal contrast, you’ll find a half a dozen of them and compare. See what kind of support service they offer, support and training they offer as well as ask them for track record and case studies and examples of how people have used their tools and how it’s helped them be successful. Alright, but there’s no one third party service. Look at your budget. You’re going to spend time and you’re going to spend money. All you get to choose is the mix. And some of the things the AI turns out, AI also make things up with an ai. Again, expect to pay money because if you are not the customer, then you are the product. And so understand you don’t want somebody taking advantage of your data either. Other questions,

ANU? Is there a similar data available for the results of formal RFIs sources sought?

No, there is not. It’s another reason to build relationships with in the small business office or in the contracting shopper with end users. And for sure, if you have the opportunity to go to an in-person industry day or a pre RFP conference for goodness sake, go because you’re going to be able to meet players at multiple layers, including competitors and competitive mates.

Great. Any major changes anticipated from the recent election?

Of course, but who the heck knows? I will say that I was surprised in 2016 by how quickly the incoming administration decided that they wanted to turn their attention to increasing the by American provisions. I guessed wrong and I thought they were going to have so many things to do that that was going to be the least of their problems. And oh, that happened fast and it took three years for the government of Canada to negotiate with that government to dial back by American provisions that conflicted with agreements that were already on the books. And so anything can happen. If you want to have a chat with me about what could happen and what your vulnerabilities could be, connect with me on LinkedIn. Absolutely. But everybody’s situation is unique. The by American Act is written, it applies to products but not to services right now for one thing. And second, the biggest attention of by American provisions that got dialed up last time were on things related to steel construction structure, big building contracts, especially ones where federal money went down to state and local government. I’m not saying that only the construction companies are going to be at risk, but that was where the attention was last time. That’s what I can tell you.

Okay, very good. So actually I think it’s worth reiterating. So if someone is talking to a buyer and they have this buy America perspective, what would you recommend for the exporter to do to handle that situation?

The interesting thing is that if somebody wants what you’ve got, if somebody wants what you do, there are often a regulation or provision that will give them a way to do it. If the problem you solve is sufficiently compelling, if your solution is head and shoulders above everybody else’s, then the mission can lead the outcome. Start by learning the rules. So you want to become familiar with and bookmark defense, federal acquisition regulation supplement, part 2, 2 5, dfars part two five. You are not going to print that up, roll it into a bat and bash your way into the contracting office’s office. That’s going to go very badly. You’re not going to ever tell a US federal buyer how to do their job. You can say that I’ve been looking and I’m wondering, can you walk me through how these provisions work or how your office interprets these kinds of provisions?

Let’s see how it works, but build a relationship, establish how you can be helpful. And you may find that your buyer finds a way to navigate what it is that you offer and finds a way to do business. And they may say, no, we can’t. And so it may be that you find that you also want an attorney and want to engage an attorney who has experience in US federal contracts to help you. In some instances that may be route you need to go. Everybody’s path for addressing it is different. But that’s all I can tell you. There’s no one size fits all approach to this. Remember that your federal buyer is human. They have everything at stake when they award work for you, they are terrified of making a mistake. They make a mistake, something goes wrong. That’s a black mark on their file that follows them around for their whole career. That impedes their ability to get a promotion that slow down in promotion affects their best three years of salary, which affects their retirement benefits, which affects their ability to care for, send their kids to the best colleges and take their grandkids to Disney. Now I’ve unpacked a whole lot of consequences from, oh, that’s why they’re so risk averse, but it’s not just professional, it’s personal in a really profound way.

On behalf of the team at CC, C and Judy, thank you very much for joining today’s session and we look forward to seeing you again. Bye everybody. Bye-Bye.